Entrepreneurship is a blend of many essential things (we will discuss one by one in future posts) and taxation is one of those essential elements which cannot be ignored while you are planning to Generate Multiple Streams of Income.

It is also a kind of a headache for every person since its beginning. Anyhow, as we all witnessed the biggest tax reform in India after 70 years of Independence in the form of GST. Now this GST has become a new trend these days and every single person is talking about it. Some of you are in favor of GST & some of you are against it. No matter what but you need to know about it as it will be involved in every possible place where economic activities occur.

Whether you are in a traditional business model or in new age business such as online business, digital marketing, affiliate marketing, blogging etc. as an entrepreneur, you must have to be aware of taxation (Direct and Indirect Taxes).

Even though it is not possible to post each and everything related to the Rules and regulations, Act, notifications, memorandums etc about every taxation. But I will help you to understand the basic part of every kind of Tax applicable in India and abroad in a simple manner through this section of our blog called ENTREPRENEURS AND TAXATION.

So, these days you all are eager to know about GST. Its applicability, implementations, registration etc. In this post, I am going to touch an overview of GST and in subsequent posts, I will try to explain it in simple layman’s day to day talk. So that you can understand it easily.

So common, Let’s start with the basics.

What is Taxation?

Taxation is a liability part, liability to Government and it is collected by Central Govt. and State Govt. on various economic transactions.

Taxation is a liability part, liability to Government and it is collected by Central Govt. and State Govt. on various economic transactions.

Further, it has two elements:

1. Direct Tax

2. Indirect Tax (GST is an Indirect Tax)

Note: We will discuss in detail in taxation dedicated posts

History of GST – The Genesis

GST was first introduced in France and now more than 150 countries have introduced GST. Most of the countries, depending on their own socio-economic formation, have introduced National level GST or Dual GST.

What is GST?

Goods and Services Tax (GST) is an indirect tax applicable throughout India which replaced multiple cascading taxes levied by the central and state governments. It was introduced as The Constitution (One Hundred and First Amendment) Act 2017, following the passage of Constitution 122nd Amendment Bill. The GST is governed by a GST Council and its Chairman is the Finance Minister of India.

GST is a consumption based tax.

The term GST is defined in Article 366 (12A) to mean “any tax on the supply of goods or services or both except taxes on the supply of the alcoholic liquor for human consumption”

In simple words, all supply of “goods or services” or “both” will attract CGST (to be levied by Centre) and SGST (to be levied by State) unless kept out of the purview of GST.

Attention!!! Bloggers and Online Entrepreneurs it is for you:

“GST will be applicable even when the transaction involves the supply of both (goods and services). In effect, works contracts will also attract GST. As GST will be applicable to ‘supply’ the erstwhile taxable events such as ‘manufacture’, ‘sale’, provision of services etc. will lose their relevance.”

So, as per above-mentioned definition, bloggers and digital marketers etc. are providers of various kinds of services related to marketing which leads to sales (i.e. economic activity). Every economic activity within the Indian territories with the Indian IP is liable to pay or charge GST.

Every digital economic activity within the Indian territories with an Indian I.P. address is liable to pay or charge GST.

For example, Facebook is now demanding GSTIN (GST Number) for Ads. It is a US based company but performing its economic activities in Indian territories, so they have to charge GST. So if you want to Advertise on FB or any other platforms, in such cases it is MANDATORY to have GST no.

Every digital entrepreneur should be careful and aware of GST applicability. Ignorance can lead you to statutory penalties. In the upcoming posts, I will explain as it is beyond the scope of this GST intro post.

New identity:

All Central Taxes would be now known as CGST and all State Taxes as SGST.

Scope of GST

1. Intra-State

• CGST

• SGST Insert Image

2. Intra-State

• IGST

As GST is a consumption-based tax, it means revenue will be finally received by the state in which goods/services are at last consumed.

Taxes to be replaced by GST:

Following are the taxes to be replaced by GST:

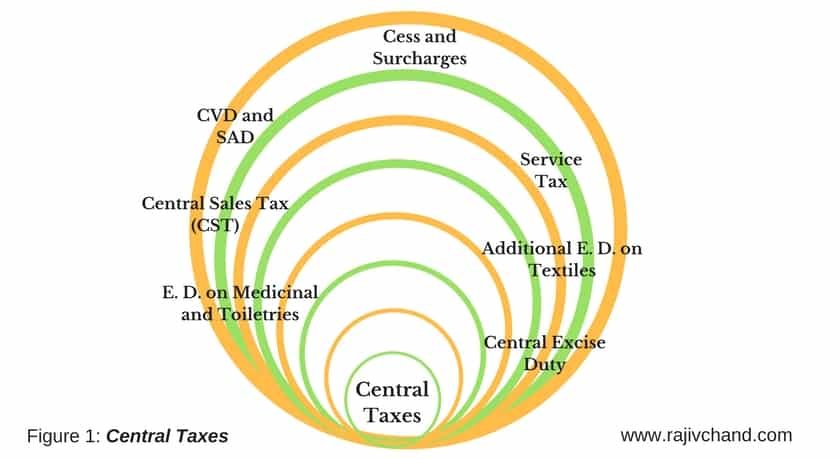

1. Central Taxes:

• Central Excise Duty

• Excise Duty on medicinal and toiletries preparation

• Additional duty of Excise on textiles and textile products

• Central Sales Tax (CST)

• Service Tax

• CVD and SAD (on Import of goods)

• Cesses and surcharges insofar as far as they related to supply of goods & services

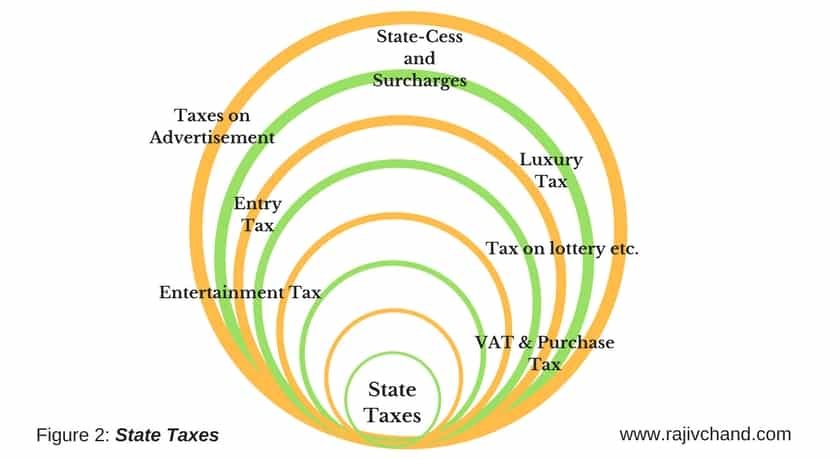

2. State Taxes:

• State VAT/Purchase Tax

• Entertainment Tax

• Tax on the lottery, betting, and Gambling

• Entry Tax

• Luxury Tax

• Taxes on Advertisement (bloggers and digital entrepreneurs are lying down under this)

• State Cesses and surcharges insofar as far as they related to supply of goods & services

That’s it for this post as GST is a broad topic. So it is beneficial to consume the information in chunks. It will save you to get overwhelmed. I hope you gained some insights from this post.

In the upcoming posts you will know about:

• Five Steps to be GST ready

• GST in India

• Ten Things You must know as an entrepreneur about GST

• Rate of GST

• Supply Chain and GST

• GST – International Scenario (as we have global readers)

• GST Model & Registration

and

• The special one “GST – E-Commerce and Digital Business

I will try to present it in pieces so that a normal person can absorb the information easily. I know this taxation part is so boring but very essential part of a business.

Please comment below about your doubts and questions about GST. Also, let me know what do you want to learn or expect from me?

Don’t lose your focus, stay connected and learn Entrepreneurship.

At the end I would like to encourage you with one of my motivational quotes:

“Entrepreneurship is not just an Open & Shut game. It is a responsibility and requires determination, enthusiasm, patience, endurance”. -Rajiv

Thanks for your valuable time, talk to you more about GST in next post.

#flyhigh & #LiveYourPassion

Courtesy: A special thanks to our beloved CA Pritam Mahure for his guidance and efforts.

A visionary, catalyst, educator, corporate strategist, successful serial entrepreneur, founder of many ventures including a Public Limited Company “Catalystic® Digiprenuer Enterprises Limited”, initiator of Arthkaar®, various socio-economic projects, and very passionate about new business opportunities; encouraging and equipping young entrepreneurs with different private and Government platforms, and a dynamic visiting faculty with the Ministry of MSME_Govt. of India and active national member with World Human Rights Protection Council to advocate Human Rights.